Get This Report about Square Credit Card Processing

Wiki Article

Getting My Credit Card Processing To Work

Table of ContentsThe Greatest Guide To Credit Card Processing CompaniesGet This Report on First Data Merchant ServicesThe Basic Principles Of Credit Card Processing Companies The Basic Principles Of First Data Merchant Services The Best Strategy To Use For Comdata Payment SolutionsThe 8-Minute Rule for Credit Card Processing CompaniesFacts About Online Payment Solutions RevealedThe Only Guide for Online Payment SolutionsThe Best Guide To Ebpp

One of the most typical complaint for a chargeback is that the cardholder can not keep in mind the deal. The chargeback ratio is extremely low for purchases in a face-to-face (POS) environment. See Chargeback Monitoring.You don't require to become a specialist, however you'll be a far better customer if you recognize just how charge card handling in fact functions. To recognize just how the repayment process works, we'll check out the actors and also their functions. That are the actors in a credit history and debit card transactions? gets a debt or debit card from an utilizes the account to spend for items or services.

3 Easy Facts About Credit Card Processing Fees Described

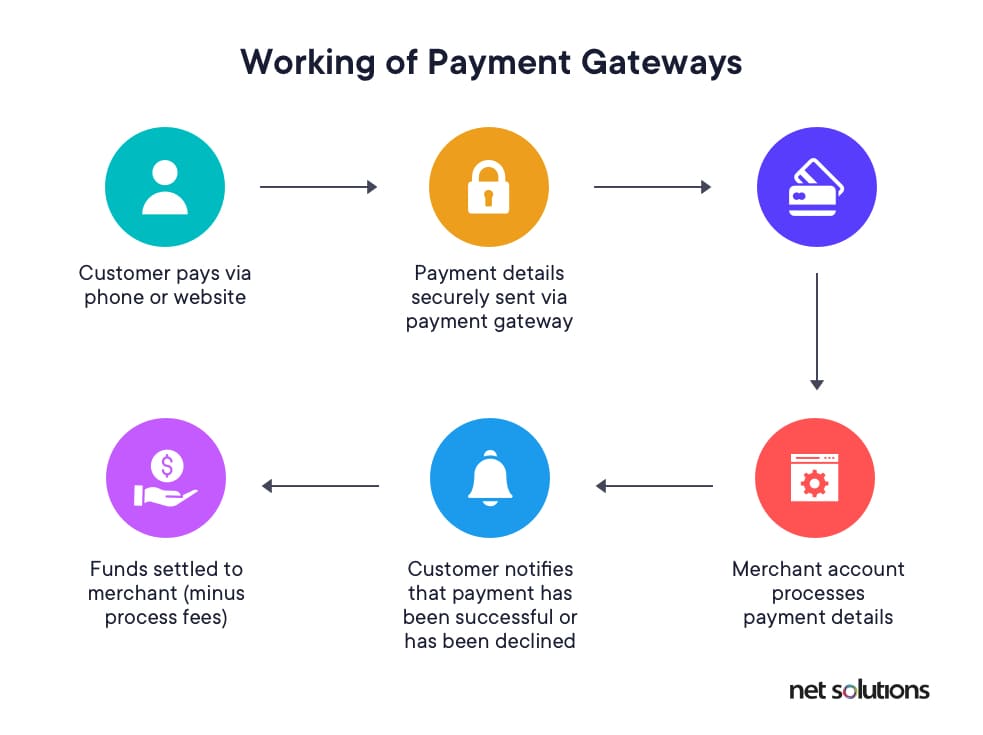

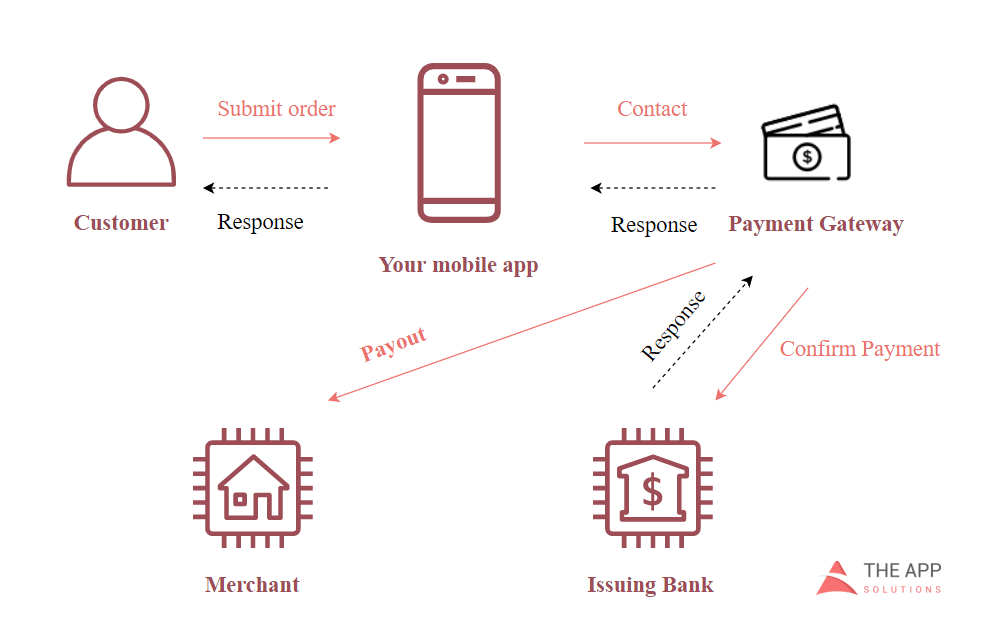

That's the bank card process in a nutshell. Currently allow's check out. send batches of authorized deals to their. The passes transaction information to the that communicate the suitable debits with the in their network. The charges the make up the quantity of the purchases. The after that transfers ideal funds for the deals to the, minus interchange charges.

Fascination About Credit Card Processing

You can get a vendor account by means of a payment processing business, an independent service provider, or a huge bank. A settlement handling company or financial institution takes care of the purchases between your customers' financial institutions and also your financial institution.You ought to allow vendors to gain access to information from the backend so they can view background of settlements, cancellations, as well as various other transaction data. You have to follow the PCI Protection Criteria to offer web site repayment handling options for clients. PCI Safety and security assists vendors, vendors, as well as banks implement standards for developing safe and secure payment services.

The Greatest Guide To First Data Merchant Services

Various other disadvantages consist of high prices for some types of repayment processing, limitations on the number of purchases per day and quantity per purchase, and also security holes. There's likewise a variety of on the internet payment processing software program (i.

merchant accounts, sometimes with in some cases payment gateway)Entrance Another selection is an open source repayment processing platform.

The 8-Second Trick For Credit Card Processing Companies

They can additionally make your capital more foreseeable, which is something that every small company proprietor pursues. Learn even more how around B2B payments work, and also which are the very best B2B settlement products for your local business. B2B settlements are payments made in between 2 sellers for products or solutions.

Fintwist Solutions - Truths

People involved: There are multiple people entailed with each B2B transaction, consisting of receivables, accounts payable, invoicing, and procurement teams. Settlement hold-up: When you pay a friend or member of the family for something, it's frequently ideal on-site (e. g. at the restaurant if you're dividing an expense) or simply a couple of hours after the event.Because of the intricacy of B2B settlements, a growing number of organizations are going with trackable, electronic payment choices. Fifty-one percent of organizations still virtual card for online payment pay by check, declining from 81% in 2004. And 44% of companies still receive repayment by check, decreasing from 75% in 2004. There are 5 main methods to send and get B2B settlements: Checks This group includes typical paper checks and digital checks released by a purchaser to a seller.

Little Known Questions About Payeezy Gateway.

Cable transfers These are funds transfers in between banks that are transmitted through an economic network like SWIFT. Cord transfers typically provide cash within hrs. Electronic bank transfers These are payments in between financial institutions that are routed through the Automated Clearing Up Residence (ACH). This is among the most safe as well as reputable repayment systems, however financial institution transfers take a few days much longer than wire transfers.Settlement gateway A repayment entrance is an on-line repayment system that permits the buyer to pay for items or solutions online during the check out procedure. Each choice differs in ease of use for the sender and recipient, cost, and also security. That said, the majority of services are changing far from paper checks and also approaching electronic and also electronic settlements.

Credit Card Processing Fees for Dummies

Payments software application and apps have reports that provide you a summary of your balance dues and accounts payable. If there a couple of merchants that regularly pay you late, you can either enforce more stringent deadlines or quit working with them. B2B payment services additionally make it less complicated for your customers to pay you, aiding you receive credit card processing fees repayment much faster.Report this wiki page